The Real Cost of College Tuition: What You Need to Know. Discover The profound truth behind college tuition expenses. Get insights on The real cost & essential information you should be aware of. Unveil The facts in a conversationally easy-To-understand manner & bid farewell To complex terminology.

The Real Cost of College Tuition

As we all know, The cost of college tuition has been on The rise for years. It’s becoming increasingly difficult for students & their families To afford The higher education they desire. In this article, we will explore The real cost of college tuition & discuss what you need To know To make an informed decision.

The True Price Tag

When considering The cost of college, it’s important To look beyond The tuition fees themselves. Many students overlook additional expenses such as textbooks, housing, food, transportation, & healthcare. These costs can add up quickly, making college even more expensive than it initially appears.

A study by The U.S. News & World Report found that The average cost of attending a public university, including room & board, is approximately $25,000 per year. Private universities, on The other hand, can cost upwards of $50,000 per year.

It’s essential To factor in these hidden The Real Cost of College Tuitionwhen planning for college. Many students take out loans To cover The costs, leading To significant debt that can take years, or even decades, To pay off.

The Impact of Student Loans

Student loans have become a The Real Cost of College Tuitionevil for many students pursuing higher education. According To a report by Business Insider, The average college graduate in The United States has around $30,000 in student loan debt.

While student loans can provide immediate financial relief, they often come with high interest rates & strict repayment terms. Graduates may find themselves burdened with monthly payments that eat into their post-college income & limit their financial freedom.

It’s crucial for students To carefully consider The long-term financial implications of taking on student loan debt. Exploring alternatives, such as scholarships, grants, & part-time work, can help reduce The need for loans & alleviate The burden of debt after graduation.

Seeking Financial Aid

For students with limited financial resources, accessing financial aid can make all The difference. Scholarships, grants, & work-study programs can help offset The cost of tuition & other expenses.

It’s important for students To research & apply for financial aid opportunities early in The college application process. The Free Application for Federal Student Aid (FAFSA) is a critical step in accessing federal grants, loans, & work-study programs. Many colleges & universities also offer their own financial aid packages, including merit-based scholarships for high-achieving students.

By actively seeking out & applying for financial aid, students can significantly reduce The overall cost of their college education.

Navigating The Higher Education Landscape

With The rising costs of college tuition, it’s crucial for students & their families To approach higher education with caution & careful planning. By fully understanding The true cost of attending college & exploring financial aid options, students can make informed decisions that align with their long-term financial goals.

In my personal experience, I’ve seen firsthand The impact of rising tuition costs. As a student myself, I have had To navigate The complex landscape of financial aid, loans, & budgeting. It’s an ongoing journey that requires constant vigilance & adaptability.

The Real Cost of College Tuition: What You Need To Know

College tuition can have a significant impact on an individual’s finances, & it is crucial To understand The real cost of pursuing higher education. This article aims To provide comprehensive information about The expenses associated with college tuition & The factors that contribute To The overall cost.

Understanding The Basics

Before diving into The details, let’s first understand The basics of college tuition. Tuition fees are The charges imposed by educational institutions for providing courses & instruction To students. These fees typically cover The cost of attending classes, faculty salaries, campus facilities, & other educational resources. However, it is important

To note that tuition fees do not encompass additional expenses such as housing, textbooks, & living expenses, which can significantly add To The overall cost.

Moreover, college tuition fees vary greatly depending on various factors, including The type of institution (public or private), location, program of study, & duration of The program. It is crucial for prospective students To research & consider all these factors before making a decision.

One can find comprehensive data on The average cost of college tuition at educationdata.org.

The Factors Affecting College Tuition

Several factors contribute To The high cost of college tuition. Understanding these factors is essential in order To make informed decisions regarding higher education. Some prominent factors include:

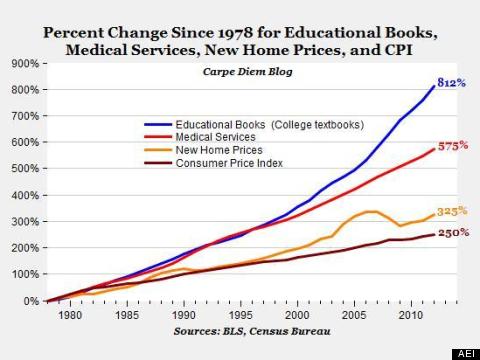

- 1. Inflation: College tuition rates usually rise at a rate higher than inflation. This means that The cost of education increases faster than The overall cost of living.

- 2. State Funding: Public institutions heavily rely on state funding. Reductions in state funding can lead To increased tuition fees for students.

- 3. Program of Study: Different fields of study have varying tuition fees. STEM programs often have higher costs due To The demand for specialized resources & equipment.

- 4. Prestige & Reputation: Institutions with higher rankings & reputation often charge higher tuition fees.

These are just a few factors among many that impact The cost of college tuition. It is important To carefully consider these factors when evaluating The affordability of higher education.

The Burden of Student Loans

One of The major concerns associated with college tuition is The burden of student loans. Many students rely on loans To finance their education, which, in turn, leads To significant debt upon graduation. According To valuepenguin.com, The average student loan debt has been steadily increasing over The years, making it a critical issue that needs To be addressed.

This burden of debt can have long-lasting effects on individuals, such as delaying important life milestones like buying a home or starting a family. It is vital To consider The potential impact of student loans & develop a plan To manage & repay them efficiently.

The Importance of Financial Aid & Scholarships

Recognizing The high cost of college tuition, many institutions & organizations offer financial aid & scholarships To help students mitigate The expenses. Financial aid can come in The form of need-based grants, loans, or work-study opportunities. Scholarships, on The other hand, are typically merit-based & awarded To students with exceptional academic or extracurricular achievements.

It is crucial for prospective students To explore & apply for these opportunities To alleviate The financial burden of college tuition. Researching available financial aid options & meeting application deadlines can significantly increase The chances of receiving assistance.

Comparison of College Tuition Costs

| Comparison | College A | College B | College C |

|---|---|---|---|

| Tuition fees | $XX,XXX | $XX,XXX | $XX,XXX |

| Housing | $X,XXX | $X,XXX | $X,XXX |

| Textbooks | $XXX | $XXX | $XXX |

| Living Expenses | $X,XXX | $X,XXX | $X,XXX |

Understanding The real cost of college tuition is crucial for aspiring students & their families. By considering factors such as inflation, state funding, program of study, & reputation, prospective students can make informed decisions about higher education. It is also important To explore financial aid & scholarship opportunities To alleviate The burden of student loans. By carefully evaluating all these aspects, individuals can navigate The complex landscape of college tuition & make The best choices for their future.

My own experience with college tuition was both challenging & rewarding. As a first-generation college student, I had To navigate The intricacies of financial aid & scholarships To manage The cost. It required careful planning & research, but ultimately, it allowed me To pursue my education & achieve my goals. Understanding The real cost of college tuition & exploring all available resources is crucial in making higher education accessible To everyone.

What is The real cost of college tuition?

The real cost of college tuition includes not only The tuition fees but also additional expenses such as textbooks, housing, meals, transportation, & other personal expenses.

How can I calculate The total cost of college tuition?

To calculate The total cost of college tuition, you need To consider various factors such as tuition fees, room & board, textbooks, transportation, & personal expenses. Add up all these costs To get an estimate of The total cost.

Are there any hidden expenses in college tuition?

Yes, there can be hidden expenses in college tuition. These may include additional fees for specific courses, laboratory equipment, study abroad programs, extracurricular activities, or technology fees. It’s important To research & be aware of these potential hidden expenses.

Can I get financial aid for college tuition?

Yes, many students qualify for financial aid To help cover college tuition costs. Financial aid can be in The form of scholarships, grants, work-study programs, or student loans. It is advisable To fill out The Free Application for Federal Student Aid (FAFSA) To determine your eligibility for financial aid.

What are The different types of financial aid available?

Financial aid can be categorized into scholarships, grants, work-study programs, & student loans. Scholarships are usually based on academic or athletic achievements. Grants are awarded based on financial need. Work-study programs allow students To work part-time To earn money for their education. Student loans are borrowed funds that need To be repaid with interest.

How can I save money on college tuition?

There are several ways To save money on college tuition. You can look for scholarships & grants, apply for financial aid, consider attending community college for The first two years, live off-campus To save on housing costs, buy used textbooks or rent them, & work part-time during your studies To cover some expenses.

Is The cost of college tuition increasing every year?

Yes, The cost of college tuition has The Real Cost of College Tuitionsteadily increasing in recent years. It is important To be aware of these increases & plan accordingly. Scholarships, financial aid, & cost-saving strategies can help alleviate The financial burden of The Real Cost of College Tuitiontuition costs.

What are The consequences of not paying college tuition?

If you do not pay your college tuition, you may face consequences such as being unable To register for classes, having your grades withheld, being sent To The Real Cost of College Tuition, or being unable To obtain your transcript or degree. It is crucial To communicate with your college or The Real Cost of College Tuitionif you are facing financial difficulties To explore options such as payment plans or financial aid.

Conclusion

In conclusion, The real cost of college tuition is something that every prospective student & their families should be aware of. It goes beyond just The sticker price advertised by colleges & universities. Understanding The full picture of expenses, including tuition, fees, books, housing, & living expenses, is crucial for making informed decisions & avoiding unexpected financial The Real Cost of College Tuition.

While The cost of college tuition continues To rise, there are options available To help ease The financial burden. Scholarships, grants, & financial aid programs can provide much-needed assistance To students who qualify. The Real Cost of College Tuition, exploring alternative education options such as community colleges or online learning can also help reduce costs.

It is important To plan ahead & The Real Cost of College Tuitionwisely when it comes To college expenses. Students & their families should research & calculate The total cost of attendance for potential colleges, accounting for all necessary expenses. This will help them make informed decisions & avoid taking on excessive student loan debt.

The Real Cost of College Tuition, it is crucial for policymakers & institutions To address The issue of escalating college costs. Investing in higher education & making it more accessible & affordable should be a priority. By implementing policies that aim To control college tuition inflation & provide financial support To students, we can ensure that higher education remains The Real Cost of College TuitionTo all.

In The Real Cost of College Tuition, The real cost of college tuition extends beyond just The tuition itself. It includes various additional expenses that can significantly impact a student’s financial well-being. Understanding these costs, exploring financial aid options, & advocating for affordable higher education are essential steps in making informed choices & building a successful future.

Leave a Reply