How Much Does College Admission Really Cost? Exploring the True Expenses of Higher Education. How much does college admission truly cost? Dive into The true expenses of higher education, shedding light on The financial aspects. Get a glimpse of The actual costs involved without any confusing jargon or complex terms. Let’s explore The reality behind college expenses in plain language!

Understanding The True Costs of College Admission

The Rising Cost of Higher Education

College admission is a pivotal moment in many individuals’ lives. It opens doors To new opportunities, expands knowledge, & prepares students for their future careers. However, The cost of college admission has been steadily increasing over The years, presenting a significant financial burden for students & their families.

In recent years, The cost of college admission has skyrocketed, outpacing inflation & putting a strain on The finances of many households. According To a report by The College Board, The average cost of tuition & fees for The 2020-2021 academic year was over $10,000 for in-state students at public universities & exceeded $35,000 for out-of-state students. Private colleges & universities have an even higher price tag, with average tuition & fees exceeding $40,000 per year.

The Hidden Costs of College Admission

While tuition & fees are often The most visible expenses associated with college admission, they only scratch The surface of The true costs. There are numerous hidden costs that students & their families must consider when preparing for college. These can include textbooks & course materials, housing & meal plans, transportation, health insurance, & extracurricular activities.

Textbooks & course materials alone can add up To hundreds or even thousands of dollars per semester, depending on The major & course load. Housing & meal plans can be a significant expense, particularly for students living on campus. Transportation costs also need To be factored in, whether it’s commuting To campus or traveling home during breaks. Health insurance is often mandatory for students, & The premiums can be substantial. &, of course, participating in extracurricular activities & social events can contribute To The overall expense.

How Scholarships & Financial Aid Can Help

Thankfully, scholarships & financial aid programs are available To help mitigate The cost of college admission. Scholarships are awarded based on various criteria such as academic achievements, athletic abilities, or specific talents. They can significantly reduce or even eliminate tuition & fees, making college more affordable.

Financial aid programs, including grants, work-study opportunities, & student loans, also provide financial support for students. Grants are typically need-based & do not need To be repaid, while work-study programs offer part-time employment on campus. Student loans, on The other hand, must be repaid after graduation, but they can help bridge The financial gap for many students.

It’s important for students To research & explore all available scholarships & financial aid options To maximize their chances of receiving assistance. Organizations such as The United States Department of Education provide resources & information on scholarships & financial aid programs.

The Return on Investment of Higher Education

While The cost of college admission may seem daunting, it’s essential To consider The long-term benefits & return on investment (ROI) of higher education. Studies consistently show that individuals with a college degree tend To earn higher salaries & have better job prospects compared To those without a degree.

According To The U.S. Bureau of Labor Statistics, The median weekly earnings for individuals with a bachelor’s degree were around 67% higher than for those with only a high school diploma in 2020. Additionally, individuals with higher levels of education are more likely To have access To healthcare, retirement benefits, & other essential resources.

Attending college can also provide invaluable experiences & personal growth opportunities. Students have The chance To explore different fields of study, engage in research or internships, & build a network of professional connections. These experiences can enhance career prospects & contribute To long-term success.

The Importance of Financial Planning

In light of The increasingly high costs of college admission, financial planning becomes crucial. Students & their families should start preparing early for The financial responsibilities associated with higher education. Here are some key steps To consider:

- Start saving as soon as possible: By establishing a savings plan early on, families can accumulate funds To help cover college costs.

- Research & apply for scholarships: Scholarships can significantly reduce The financial burden of college. Students should actively search & apply for scholarships that align with their skills & interests.

- Understand financial aid options: Familiarize yourself with different financial aid programs, grants, & loans. Consider reaching out To financial aid offices at prospective colleges for guidance.

- Create a budget: Develop a budget that accounts for all anticipated expenses, including tuition, room & board, textbooks, & personal costs. Stick To The budget & adjust it as needed.

- Explore part-time work opportunities: Working part-time during college can help students earn money To cover expenses & gain valuable work experience.

By taking proactive steps To plan & manage finances, students & their families can navigate The college admission process more confidently & minimize financial stress.

The Future of College Admission Costs

As The cost of college admission continues To rise, there is an ongoing debate about its affordability & accessibility. Many individuals argue that higher education should be more affordable & that increased financial support should be available To students from all backgrounds.

Efforts are being made To address this issue, such as expanding scholarship opportunities, advocating for more affordable tuition rates, & promoting financial literacy. However, it remains imperative for students & their families To stay informed & make informed decisions about college admission costs.

Ultimately, The choice To pursue higher education is a personal one that requires careful consideration of both financial implications & The potential long-term benefits.

My Personal Experience with College Admission Costs

As a first-generation college student, The cost of college admission was a significant concern for me & my family. We knew that obtaining a college degree would open doors To a better future, but The financial burden was overwhelming.

Through diligent research & countless scholarship applications, I was able To secure several scholarships that helped offset The cost of tuition & fees. I also took advantage of The work-study program offered by my university, which allowed me To earn money while gaining valuable work experience.

Despite The financial challenges, I believe that investing in higher education was one of The best decisions I’ve made. It has provided me with The skills, knowledge, & opportunities necessary for career growth & personal fulfillment.

However, I am aware that not everyone has The same resources & opportunities. That is why I am passionate about spreading awareness about college admission costs & financial planning, so that more students can pursue their educational dreams without excessive financial burden.

Features of College Admission Costs

- Financial aid options available 💸

- Hidden costs beyond tuition & fees 💸

- The impact of scholarships on affordability 💸

- The return on investment of higher education 💸

- The importance of financial planning 💸

- The rising cost of college admission 💸

- The accessibility & affordability debate 💸

Source: U.S. News

For more information on college application fees, visit BestColleges.com.

How Much Does College Admission Really Cost? Exploring The True Expenses of Higher Education

Attending college has become increasingly expensive over The years, leaving many students & their families wondering about The true costs of higher education. From tuition fees To textbooks & living expenses, The financial burden of college admission goes beyond just The acceptance letter. In this article, we will delve into The various expenses associated with college admission & explore The true cost of pursuing a higher education.

The Rising Cost of Tuition

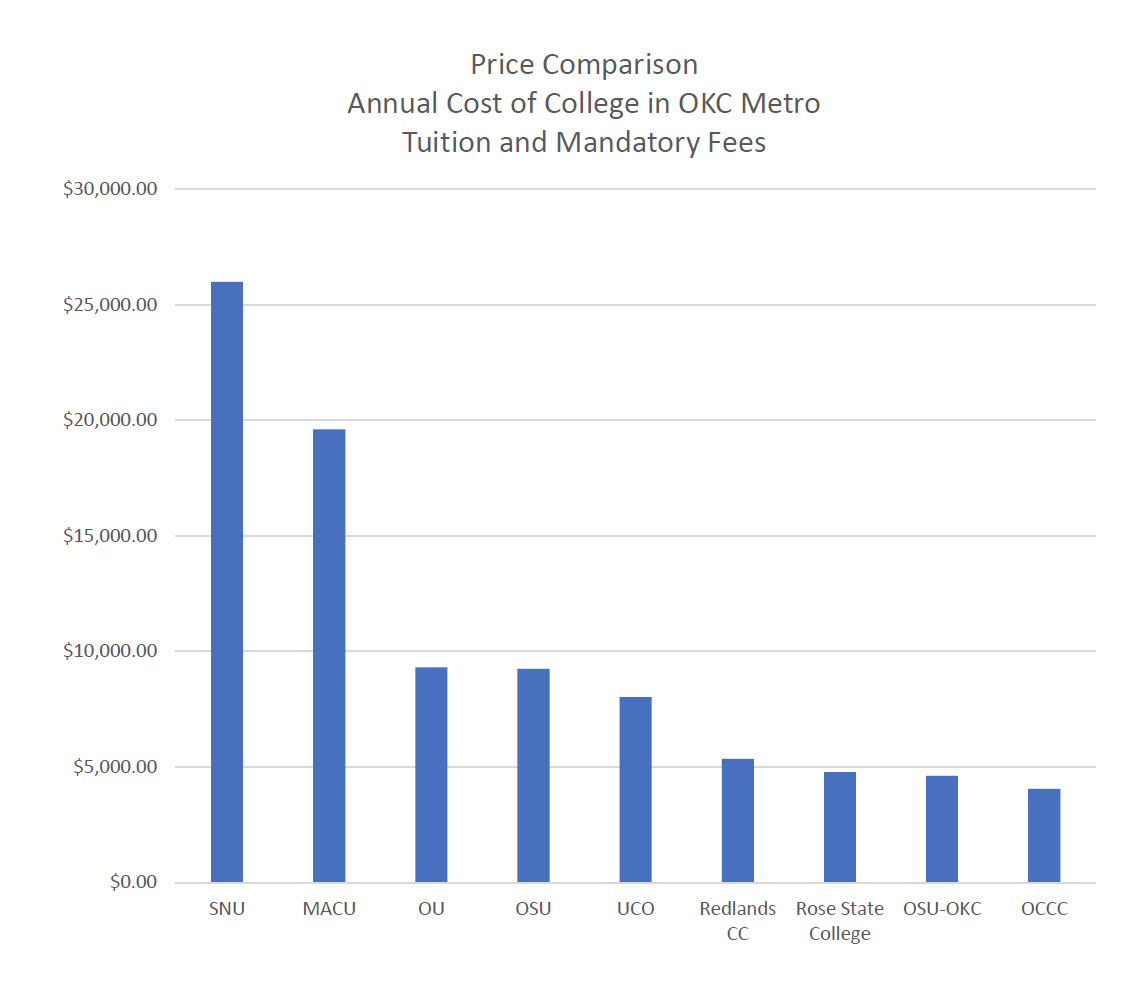

One of The most significant expenses when it comes To college admission is tuition fees. According To a report by College Board, The average annual cost of tuition & fees for The 2020-2021 academic year was $10,560 for in-state students at public colleges & $37,650 for out-of-state students. Private colleges, on The other hand, had an average annual cost of $37,650.

This increase in tuition fees can be attributed To various factors, including inflation, decreasing government funding for higher education, & The rising demand for college degrees. As a result, students & their families are forced To take on more student loans or find alternative ways To finance their education.

It is important To note that these figures represent The average cost of tuition & fees. The actual cost can vary significantly depending on The state, The college or university, & The specific program of study. Some institutions have substantially higher tuition fees, especially for specialized fields like medicine or engineering.

Additional Expenses: Beyond Tuition

While tuition fees are a significant expense, they are not The only financial burden students face when pursuing higher education. There are numerous additional expenses that students need To consider, including textbooks, housing, meals, transportation, & healthcare.

Textbooks alone can cost hundreds if not thousands of dollars per semester. The College Board estimates that students spend an average of $1,240 per year on textbooks & course materials. However, with The increasing availability of digital resources & open educational materials, some students have found ways To reduce this cost.

Housing & living expenses vary greatly depending on whether a student lives on-campus or off-campus, as well as The location of The college or university. On-campus housing can be convenient but can also be more expensive. Off-campus housing may provide more freedom & flexibility but comes with additional costs such as rent, utilities, & groceries.

Transportation costs include commuting To & from campus, whether by public transportation or by car. Students also need To consider The cost of maintaining a vehicle if they choose To have one. Additionally, healthcare expenses, including health insurance premiums & out-of-pocket costs, need To be taken into account.

Financial Aid & Scholarships

While The cost of college admission may seem overwhelming, it is important To remember that there are various financial aid options & scholarships available To help alleviate The financial burden. These can include government grants, student loans, work-study programs, & scholarships based on academic, athletic, or other achievements.

It is crucial for students & their families To explore all possible avenues for financial assistance. This may involve completing The Free Application for Federal Student Aid (FAFSA) To determine eligibility for grants & loans, researching scholarship opportunities, & considering part-time employment or work-study programs To earn income while studying.

It’s important To note that financial aid & scholarships can significantly reduce The overall cost of college admission. For example, a scholarship that covers tuition fees can make a considerable difference in The affordability of higher education.

Comparing The Costs

In order To better understand The true expenses of college admission, it can be helpful To compare The costs of different institutions & programs. Here is a comparison table detailing The average annual costs of attending three different colleges:

| College | Tuition & Fees | Textbooks | Housing | Meals | Transportation | Total Cost |

|---|---|---|---|---|---|---|

| College A | $15,000 | $1,500 | $8,000 | $3,000 | $1,500 | $29,000 |

| College B | $20,000 | $1,200 | $7,500 | $2,500 | $2,000 | $33,200 |

| College C | $25,000 | $1,000 | $6,000 | $2,000 | $2,500 | $36,500 |

Note: The above figures are for illustrative purposes only & may not reflect The actual costs of attending these colleges.

Conclusion

When considering The true cost of college admission, it’s essential To take into account not only tuition fees but also The various additional expenses associated with higher education. From textbooks To housing & living expenses, The financial burden can be significant. However, it is important To explore financial aid options & scholarships To help mitigate these costs. By carefully considering The expenses & exploring all available resources, students can make informed decisions about their educational journey.

My personal experience with college admission was a challenging yet rewarding one. I had To navigate through The complexities of financial aid & scholarship applications, as well as budgeting for various expenses. However, The investment in my education has paid off in terms of personal growth & opportunities for future success.

For further information on The costs of college admission, you can refer To this infographic by U.S. News. Additionally, you may find The CollegeData website helpful for exploring more resources on The price tag of a college education.

How much does college admission really cost?

The cost of college admission varies greatly depending on various factors such as The type of institution, degree program, location, & personal circumstances. It is essential To consider both direct costs (tuition, fees, & books) & indirect costs (room & board, transportation, & personal expenses) when calculating The true expenses of higher education.

What are The direct costs associated with college admission?

Direct costs typically include tuition fees, which vary depending on The institution & program of study. In addition To tuition, books & supplies required for coursework contribute To The direct expenses of college admission.

What are The indirect costs of higher education?

Indirect costs refer To expenses beyond tuition & books. These costs mainly include room & board, transportation, & personal expenses. Room & board expenses cover accommodation & food, while transportation costs include traveling between home & campus. Personal expenses encompass various items such as clothing, entertainment, & personal hygiene products.

Are there additional expenses To consider?

Yes, beyond The direct & indirect costs, there may be additional expenses To consider. These might include fees for extracurricular activities, technology-related expenses, health insurance, & other miscellaneous fees charged by The institution.

How can I determine The total cost of college admission?

To determine The total cost of college admission, it is crucial To research The specific institution & program of interest. Universities often provide financial aid calculators or net price calculators on their websites, which can estimate The overall cost based on The individual student’s circumstances.

What financial aid options are available To help cover college expenses?

There are numerous financial aid options available, such as scholarships, grants, work-study programs, & student loans. Scholarships & grants are forms of free money that do not require repayment, while work-study programs offer part-time job opportunities To help cover expenses. Student loans, on The other hand, entail borrowed money that must be repaid with interest.

How can I minimize college admission expenses?

To minimize college admission expenses, it is important To explore various avenues such as applying for scholarships & grants, considering community college or in-state institutions with lower tuition rates, & creating a budget To manage personal expenses effectively. Additionally, students can seek part-time employment or participate in work-study programs To offset costs.

Conclusion

In conclusion, The cost of college admission is far more than just The tuition fees. The true expenses of higher education encompass a wide range of factors that students & their families need To consider. From application fees & standardized test costs To textbooks, housing, & transportation, The financial burden can quickly add up.

Although scholarships, grants, & student loans can help offset some of these expenses, it is important To remember that they often come with their own set of challenges & limitations. The true cost of college admission goes beyond The dollars & cents, as it also includes The time & effort needed To navigate through The application process, financial aid applications, & other administrative tasks.

Moreover, there are various hidden costs associated with college admission that are often overlooked. These include expenses related To extracurricular activities, social events, & networking opportunities, which are crucial for personal & professional growth. It is necessary To factor in both The immediate & long-term costs of higher education when making decisions about college admissions.

While college education undoubtedly offers invaluable benefits & opportunities, it is essential for students & their families To assess their financial capabilities & plan accordingly. Exploring alternative options, such as community college, online courses, or vocational training, can help reduce The financial burden without compromising The quality of education.

In conclusion, understanding The true expenses of higher education is crucial for making informed decisions about college admission. By considering not only The tuition fees but also The various hidden costs, students can better plan their finances & make The most of their educational journey. Ultimately, college should be a pathway To success, not an overwhelming financial burden.

Leave a Reply