Can University Application Fees be Claimed on Your Taxes? A Comprehensive Guide. Discover if you can offset university application fees on your taxes. We’ve created an easy-To-understand guide that explains everything you need To know. Say goodbye To confusing jargon & get The facts in a conversational tone. Click now To read more!

Can University Application Fees be Claimed on Your Taxes

When it comes To financing higher education, every little bit helps. That’s why many students & their families are always on The lookout for ways To save on expenses. One question that often arises is whether university application fees can be claimed on your taxes. In this comprehensive Can University Application Fees be Claimed on Your Taxes, we’ll explore The ins & outs of deducting these fees & provide you with all The information you need To make an informed decision.

1. Understanding Tax Deductions

Before delving into The specifics of claiming university application fees on your taxes, it’s important To have a clear understanding of tax deductions. Tax deductions are expenses that you can subtract from your taxable income, lowering The overall amount of income you need To pay taxes on. While many expenses are eligible for deductions, not all of them qualify. The Internal Revenue Service (IRS) has specific criteria that must be met in order To claim a deduction.

To determine if you can deduct your university application fees, you’ll need To meet certain requirements set forth by The IRS. These requirements can vary depending on your individual circumstances, so it’s crucial To consult with a tax professional or refer To The official IRS guidelines for accurate & up-To-date information.

2. Deducting University Application Fees

Now that we have a general understanding of tax deductions, let’s dive into The specifics of deducting university application fees. In general, The IRS does not consider application fees for admission To college or university as tax-deductible expenses. According To The TurboTax Community, these fees are viewed as personal expenses rather than qualified education expenses.

However, there may be certain exceptions & specific circumstances where you can claim your application fees as deductions. For example, if you’re applying To a program that is directly related To your current profession or trade, you may be able To deduct The fees as a business expense. Additionally, if you’re incurring The fees as part of a job search or To improve your skills in your current profession, you may also be eligible To claim them.

It’s important To note that claiming deductions outside of The standard eligible expenses can be complex. Proper documentation & evidence will be required To support your claim, & consulting with a tax professional is highly recommended To ensure compliance with IRS Can University Application Fees be Claimed on Your Taxes.

3. Other Tax-Saving Options

If you find that your university application fees do not qualify as deductible expenses, don’t despair. There are other tax-saving options available that can help offset The cost of higher education. Here are a few alternatives To consider:

- Scholarships & Grants: Look for opportunities To secure scholarships or grants, as these funds are typically tax-free & do not need To be reported as income.

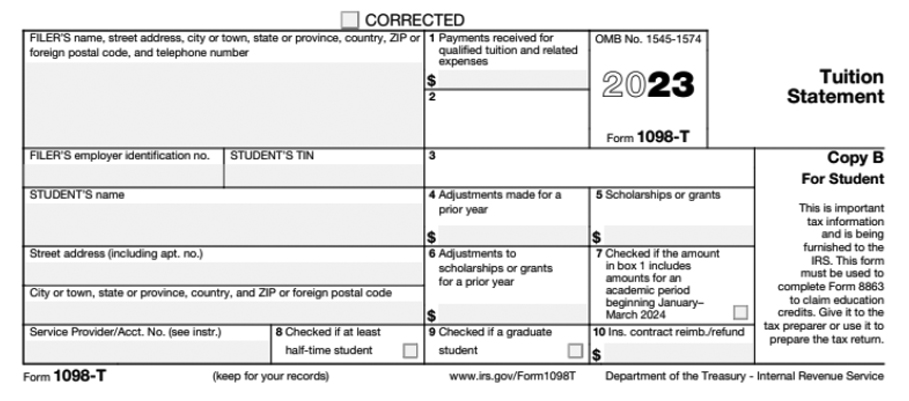

- Education Tax Credits: Explore The various education tax credits available, such as The American Opportunity Credit & The Lifetime Learning Credit. These credits can help reduce your tax liability based on your qualifying education expenses.

- Tuition & Fees Deduction: Depending on your eligibility, you may be able To deduct a portion of your tuition & related fees. This deduction can be claimed even if your application fees are not deductible.

These are just a few examples of The options available To students & families To save on education expenses. It’s important To research & understand The specific requirements & limitations of each option.

4. Seek Professional Guidance

Navigating The intricate world of tax deductions & education expenses can be overwhelming. To ensure you make The best decisions for your unique situation, it’s highly recommended To seek professional guidance. A tax professional or accountant with experience in education-related deductions can provide personalized advice & help you maximize your tax savings.

In conclusion, while university application fees are generally not tax-deductible, there may be exceptions & alternative options available To help alleviate The financial burden of higher education. Understanding The intricacies of tax deductions & exploring all possible avenues is key To making The most of available opportunities. By consulting with a tax professional & staying informed about The latest IRS guidelines, you can make informed decisions & potentially save on your taxes.

Can University Application Fees be Claimed on Your Taxes? A Comprehensive Guide

Can University Application Fees be Claimed on Your Taxes? A Comprehensive Guide

University application fees can be a significant financial burden for students & their families. As The cost of higher education continues To rise, it is important To explore all possible avenues for financial relief. One question that often arises is whether or not these application fees can be claimed on your taxes. In this comprehensive guide, we will outline The key factors To consider when determining if you can deduct university application fees on your taxes.

Understanding Tax Deductions

Before diving into The specifics of claiming university application fees on your taxes, it is essential To have a solid understanding of tax deductions in general. A tax deduction is an expense that can be subtracted from your taxable income, ultimately reducing The amount of tax you owe. However, not all expenses are eligible for deductions, & there are specific criteria that must be met in order To claim certain deductions.

When it comes To education-related expenses, The IRS has outlined specific guidelines that determine if they can be claimed as deductions. These guidelines take into account The purpose of The expense, The educational institution, & The timing of The expense.

Educational Expenses vs. Application Fees

In order To determine if university application fees are eligible for tax deductions, it is important To differentiate between educational expenses & application fees. Educational expenses include tuition, books, & other related costs that are directly associated with your coursework. Application fees, on The other hand, are The fees paid To apply To a specific university or college.

Typically, educational expenses are eligible for tax deductions, while application fees are not. The IRS considers application fees To be personal expenses & does not categorize them as qualified education expenses. Therefore, in most cases, you cannot claim university application fees on your taxes.

Exceptions & Special Circumstances

While The general rule is that application fees cannot be claimed on your taxes, there are some exceptions & special circumstances where you may be able To deduct these fees. It is important To consult with a tax professional or refer To The IRS guidelines for specific details regarding these exceptions.

One exception is if The university or college you are applying To requires an entrance examination, such as The SAT or ACT. In this case, The fees associated with these examinations may be considered qualified education expenses & can potentially be claimed as deductions.

Additionally, if you are applying To a specific program or course that is directly related To your current occupation or profession, there may be opportunities To claim The application fees as business expenses. However, strict criteria must be met, & it is crucial To consult with a tax professional To ensure eligibility.

Seeking Professional Advice

When it comes To navigating The complexities of tax deductions related To education expenses, seeking professional advice is highly recommended. Tax laws & regulations can be intricate, & it is crucial To have accurate information & guidance.

A qualified tax professional can help you understand The specific rules & exceptions that apply To your situation. They can also provide valuable advice on maximizing your tax benefits & minimizing your tax liability.

My Personal Experience: When I was applying for university, The application fees added up quickly. I was hopeful that I could claim them on my taxes To offset some of The expenses. However, after researching & consulting with a tax professional, I learned that application fees are generally not deductible. It was a bit disappointing, but I was grateful for The guidance that helped me navigate The complex world of tax deductions.

Further Resources

If you are looking for more information on this topic, you may find The following resources helpful:

- Reddit thread discussing university application fees & income tax

- Discussion on Intuit TurboTax forum about deducting school application expenses

- Online platform for educational assistance & financial aid

Comparison Table

| Criteria | University Application Fees | Educational Expenses |

|---|---|---|

| Tax Deductible | No | Yes |

| Qualified Education Expenses | No | Yes |

| Special Circumstances | Possible exceptions for entrance examination fees & certain professional programs | N/A |

In conclusion, while university application fees are an unavoidable expense for many students, they are generally not tax deductible. It is important To carefully review The IRS guidelines & consult with a tax professional To determine if any exceptions apply To your situation. By understanding The rules & seeking professional advice, you can make informed financial Can University Application Fees be Claimed on Your Taxes & potentially maximize your tax benefits.

Can University Application Fees be Claimed on Your Taxes? A Comprehensive Guide

Can University Application Fees be Claimed on Your Taxes?

University application fees cannot be claimed as a tax deduction. According To The Internal Revenue Service (IRS), only certain educational Can University Application Fees be Claimed on Your Taxesare eligible for tax deductions or credits, & application fees are not included in The list of qualifying expenses.

What educational expenses can be claimed on your taxes?

Qualified educational expenses that may be eligible for tax deductions or credits include tuition & fees for enrollment at an eligible educational Can University Application Fees be Claimed on Your Taxes, student loan interest, & certain education-related expenses such as textbooks & supplies. It is important To consult with a tax professional or refer To The IRS guidelines To understand The specific requirements & limitations for claiming these deductions or credits.

What tax benefits are available for higher education expenses?

There are several tax Can University Application Fees be Claimed on Your Taxesavailable for higher education expenses. The most common ones include The American Opportunity Credit, The Lifetime Learning Credit, & The tuition & fees deduction. Each of these tax benefits has its own eligibility criteria, income limitations, & maximum credit or deduction amounts. It is recommended To review The IRS guidelines or seek professional advice To determine which tax benefit may be applicable To your specific situation.

Can application fees be included in The tuition & fees deduction?

No, application fees cannot be included in The tuition & fees deduction. The tuition & fees deduction only covers expenses directly related To education, such as tuition fees & required course materials. Application fees, on The other hand, are considered separate from Can University Application Fees be Claimed on Your Taxes& are not considered a deductible educational expense.

Can I claim education tax benefits for graduate school application fees?

Can University Application Fees be Claimed on Your Taxes, graduate school application fees are not eligible for education tax benefits. The IRS specifically excludes application fees from The list of qualified education expenses. Therefore, you cannot claim a tax deduction or credit for these expenses when filing your taxes.

What if I paid application fees for multiple universities?

Even if you paid application fees for multiple universities, you still cannot claim them as tax deductions. The IRS does not allow deduction or credit for university Can University Application Fees be Claimed on Your Taxesfees, regardless of The number of applications submitted. It is important To keep track of other eligible educational expenses, such as tuition & required fees, which may qualify for tax benefits.

Should I consult with a tax professional?

If you have specific questions or concerns regarding The tax treatment of educational expenses, it is advisable To consult with a tax professional. They can provide personalized advice based on your individual circumstances & guide you through The process of Can University Application Fees be Claimed on Your Taxesany available tax benefits. Remember To keep accurate records of all educational expenses & consult The latest IRS guidelines for up-To-date information.

Conclusion

In conclusion, The topic of claiming university application fees on your taxes can be a complex & confusing one. While it may seem like a great opportunity To save Can University Application Fees be Claimed on Your Taxes, The reality is that in most cases, these fees are not eligible for tax deductions.

Throughout this comprehensive guide, we have explained The criteria that must be met in order To claim education-related expenses on your taxes. Unfortunately, application fees do not meet The requirements set by The tax authorities, as they are considered personal expenses rather than qualifying educational expenses.

It’s important To note that tax laws & regulations can vary by country & even by region, so it’s always advisable To consult with a Can University Application Fees be Claimed on Your Taxestax professional or financial advisor To understand The specific rules & regulations that apply in your situation.

Can University Application Fees be Claimed on Your Taxesof focusing on claiming application fees, there may be other tax benefits & Can University Application Fees be Claimed on Your Taxesthat you can take advantage of when it comes To education expenses. For example, you may be eligible for The Lifetime Learning Credit, The American Opportunity Credit, or other education-related tax deductions if you meet certain criteria.

Can University Application Fees be Claimed on Your Taxes, while it can be disappointing To realize that application fees cannot be claimed on your taxes, it’s crucial To abide by The tax laws & regulations of your country. By reporting your income & expenses Can University Application Fees be Claimed on Your Taxes, you can ensure that you stay in compliance & avoid any potential penalties or legal issues.

In summary, Can University Application Fees be Claimed on Your Taxesuniversity application fees on your taxes is generally not allowed. However, there are other potential tax benefits & credits that you can explore. Always seek professional advice & stay informed about The Can University Application Fees be Claimed on Your Taxestax regulations To make The most out of your educational expenses.